In a perpetual inventory system, the expenditure account grows, and sales costs rise as you sell things. The costs of sales, often known as the cost of goods sold (COGS), are the outright costs related to producing commodities over a specific period. These costs do not include distribution or sales costs, only labor, and material costs. Businesses value their stock using the FIFO (first-in, first-out) cost flow assumption.

How to Effectively Manage Orders for Your Ecommerce? Order Management System 101

Understanding which stock is available at a given time requires constant updates or a perpetual system. Table6.1 There are severaldifferences in account recognition between the perpetual how to calculate vacation accruals free pto calculator andperiodic inventory systems. When searching for your perpetual inventory software, keep an eye out for features your business operations needs and would benefit from most.

How TopBuxus 10x’d Sales Volume in Just 4 Months with ShipBob [Case Study]

Perpetual inventory systems correctly reflect the amount of inventory on hand. They maintain a running balance of both the inventory on hand and the cost of goods sold. In perpetual inventory systems, computer programs and software are typically used to record and report transactions as soon as they take place. It can be cumbersome and time-consuming, as it requires you to manually count and record your inventory.

What are the main perpetual inventory methods?

The LIFO (last-in, first-out) perpetual inventory method is the opposite of FIFO and makes a cost flow assumption that the last items received in inventory are the first items sold. So, the inventory remaining at the end of the period is the oldest purchased or produced. The FIFO (first-in, first-out) perpetual inventory method makes a cost flow assumption that the first items received in inventory are the first items sold. So, the inventory remaining at the end of the period is the most recently purchased or produced. Although many small businesses still use more traditional periodic inventory systems, they could also benefit from the accurate real-time updates of a perpetual inventory system. A perpetual inventory control system tracks inventory in real time and centralizes inventory data.

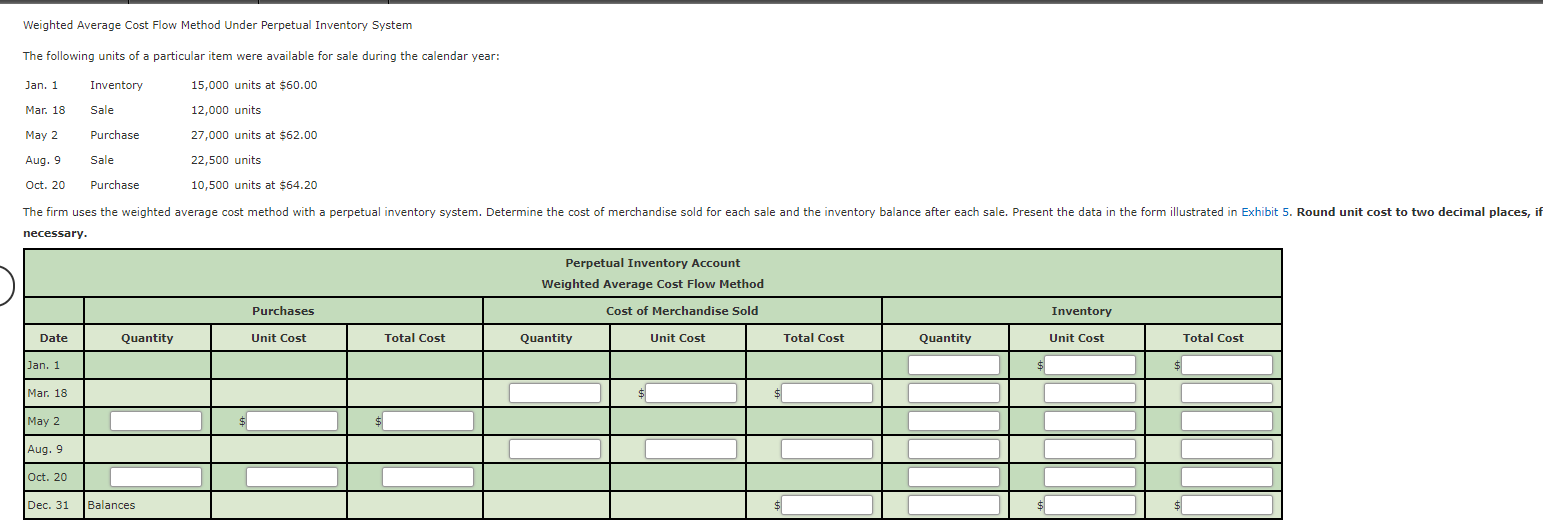

You can use WAC to calculate an average unit cost, COGS for a period and ending inventory for a period. For example, Ava wants to figure out the average cost to assign for Acetone repackaged in her company’s warehouse. She will use this information to calculate the ending inventory and COGS for the period. See the ledger below for transactions for Acetone in Jan. using a weighted average. Huge businesses have difficulty performing the cycle counts that are necessary for a periodic system.

- The decision between adopting a perpetual or periodic inventory system depends on factors like business size, transaction volume, and the need for real-time data.

- The cost of goods sold includes elements like direct labor and materials costs and direct factory overhead costs.

- Ava’s business uses the calendar year (starting on Jan. 1 and ending Dec. 31) for recording inventory.

- While perpetual inventory systems offer rich information for management, maintaining these systems is costly and time-consuming, unless the firm has completely computerized its inventory control system.

In this article, we’ll share what a perpetual inventory system is and how it works. A typical journal entry would show which account the software debited and which account the software credited for each transaction. While there is a constant, automatic product tracking system, there are still ways to lose positive inventory control.

For companies under a periodic system, this means that the inventory account and COGS figures are not necessarily very fresh or accurate. Since businesses often carry products in the thousands, performing a physical count can be difficult and time-consuming. Imagine owning an office supply store and trying to count and record every ballpoint pen in stock. Companies can choose among several methods to account for the cost of inventory held for sale, but the total inventory cost expensed is the same using any method. The difference between the methods is the timing of when the inventory cost is recognized, and the cost of inventory sold is posted to the cost of sales expense account.

Periodic systems could hinder decision-making for these types of organisations. Periodic systems are more suitable for businesses not affected by slow inventory updates. These include emerging businesses, ones that offer services or companies that have low sales volume and easy-to-track inventory. Companies whose staff struggle with a perpetual system, for instance those with seasonal help, would also benefit from maintaining a periodic system.